Auto Leasing

Lease Calculator And Trading

Auto leasing: When a topic comes up relating to car lease, the majority of people will instinctively assume a low-monthly payment.

Fees involved in leasing There is in reality more than what meets the eye, and a number of fees are involved at various stages of the lease process. At the beginning of the lease, you have to pay a refundable security deposit, typically equivalent to one monthly payment, to safeguard against non-payment and any incidental damage done to the car at the end of the lease.

Auto Lease Calculator

You are also required to pay an administrative charge, called acquisition fee. Other fees include licenses, registration, title and any state or local taxes where applicable. During your lease, you are expected to honor your monthly payment obligations. Any failure to do so will result in late-payment charges. You may have to pay any traffic tickets, emission and safety inspections and ongoing maintenance costs.

Ending your lease early will result in substantial early termination charges. At the end of the lease, expect to pay any excess mileage costs, charged at a set fee. Any incidental damage done to the car, and deemed to be above normal, will result in excess tear-and-wear charges. Finally, if you choose not to purchase the vehicle, then you have to pay a disposition fee.

Using lease calculators Want to calculate your monthly lease payment? Consider using a lease calculator If you are thinking of a car lease, it would help to know some key figures involved in the deal.

The monthly lease payments, the overall cost of the lease, and how much savings can be made compared to purchasing the vehicle. A lease calculator relieves you from the stress of having to know the complex underlying lease formula used in calculations. You simply plug a number of figures into the calculator and hey presto! You get a detailed rundown of detailed payments, taxes and total lease costs.

Figures you need to get from your dealer about a specific lease you’re interested in include: capitalized cost, estimated residual value at the end of the lease, the number of months in your lease and the money factor. Make assumptions and change some of the figures to see how it affects your lease payments.

For instance, residual value is an “estimated” value of what the vehicle will be worth at the end of the lease. You can input different estimates to cover different scenarios and assumptions. As a final note of caution, bear in mind that lease calculators only do calculations and check the accuracy of abstract mathematical formula. They do not tell you whether a lease is good or bad.

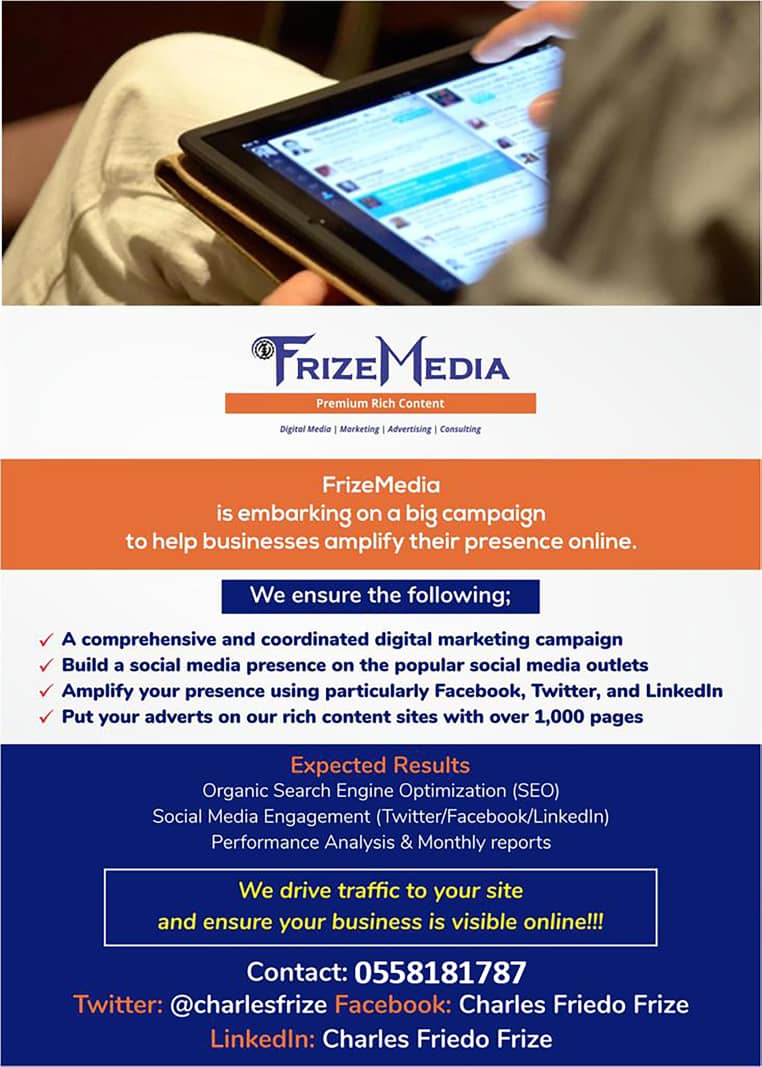

We Are Helping 1000 Businesses Amplify Their Online Presence

Lease Trading Ever wanted to terminate your lease early, comfortable with the thought you weren’t going to be hit with hefty fees? You can if you transfer your lease to someone else.

Trading a lease is the best option for people who want to terminate a lease early and don’t want to pay the large termination imposed by most lease agents. It can also be an alternative to get out of a lease for far less than you would otherwise pay your original lease company for extra mileage

and wear-and-tear charges that can be hefty.

For a small fee, you can advertise your car lease for assumption to a large number of potential buyers on the look-out for leases on the Internet. Such services can be found online.

Before swapping your lease, make sure your leasing company approves lease transfer transactions. Caution must be exercised in choosing a lease swapping service: make sure they facilitate the whole lease transfer process, offer online or telephone customer-service help and registered buyers undergo stringent credit checks.

Pay Day Cash Advance Tips And Guide

Browse All Our Informative Topics

InternetBusinessIdeas-Viralmarketing Home Page

Tweet

Follow @Charlesfrize

New! Comments

Have your say about what you just read! Leave a comment in the box below.