Forex Market Trading

Tips To Start Trading The Forex Market

#Forex Market Trading - #Trading Tips. Discover key insights into the world of forex market trading by incorporating these expert strategies for currency and finance. Delve deeper into the realm of trading with valuable tips from seasoned professionals in the field. Navigate the complexities of the forex market with precision and confidence as you explore the wealth of information available at FrizeMedia. Stay ahead of the curve and make informed decisions by leveraging the expertise and guidance provided by industry experts.

Enhance your understanding of forex trading through practical examples that illustrate the application of these expert tips in real-world scenarios. By incorporating these strategies into your trading routine, you can improve your overall performance and increase your chances of success in the competitive forex market.

Statistics show that traders who adopt a strategic approach to forex trading are more likely to achieve consistent profits and minimize risks. By following the advice of experienced professionals and staying informed about market trends and developments, you can position yourself for long-term success in the dynamic world of currency trading.

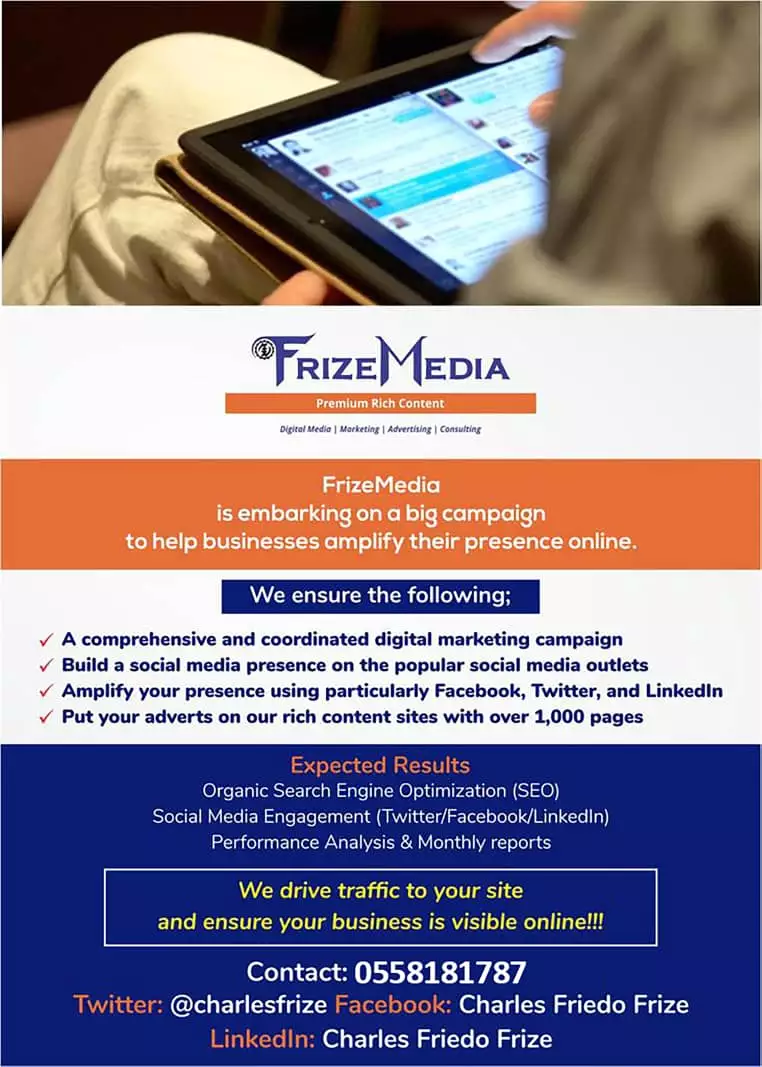

Explore the comprehensive resources available at FrizeMedia to access a wealth of information on forex market trading. From in-depth analysis to practical tips and strategies, FrizeMedia offers a one-stop destination for traders looking to enhance their knowledge and skills in the field of finance and currency trading. Take your trading game to the next level with expert insights and guidance from industry leaders.

Forex market trading.Why is FOREX trading so popular? Because you can trade from anywhere. From your kitchen table, bedroom, garage or from the nearest Starbucks coffeehouse. When you want to start trading the Forex Market nobody is going to ask ask you for a diploma, a formal license or a proof of how many hours you have spent studying the Foreign Exchange Market and/or Banking Industry. FOREX Trading is Economical and the Start-up Costs are Low! You can open an account to trade Forex with as little as US$ 200 at most brokerage firms.

The Main Benefits of Trading the FX Spot Market are: YOU don't pay commissions or fees! YOU can trade 24-hours a day ! YOU can trade up to 400:1 Leverage ! YOU can have FREE Streaming executable Price quotes and live charts!

It is important to know the differences between cash FOREX (SPOT FX) and currency futures. In currency futures, the contract size is predetermined. With FOREX (SPOT FX), you may trade electronically any desired amount, up to $10 Million USD. The futures market closes at the end of the business day (similar to the stock market).

If important data is released overseas while the U.S. futures markets is closed, the next day's opening might sustain large gaps with potential for large losses if the direction of the move is against your position. The Spot FOREX market runs continuously on a 24-hour basis from 7:00 am New Zealand time Monday morning to 5:00 pm New York Time Friday evening. Dealers in every major FX trading center (Sydney, Tokyo, Hong Kong/Singapore, London, Geneva and New York/Toronto) ensure a smooth transaction as liquidity migrates from one time zone to the next.

Furthermore, currency futures trade in non-USD denominated currency amounts only, whereas in spot FOREX, an investor can trade in almost any currency denomination, or in the more conventionally quoted USD amounts. The currency futures pit, even during Regular IMM (International Money Market) hours suffers from sporadic lulls in liquidity and constant price gaps. The spot FOREX market offers constant liquidity and market depth much more consistently than Futures.

With IMM futures one is limited in the currency pairs he can trade. Most currency futures are traded only versus the USD. With spot FOREX, you may trade foreign currencies vs. USD or vs. each other on a 'cross' basis, for example: EUR/JPY, GBP/JPY, CHF/JPY, EUR/GBP and AUD/NZD. More and more well informed investor and entrepreneurs are diversifying their traditional investments like stocks, bonds & commodities with foreign currency.

RISK WARNING: Risks of currency trading: Margined currency trading is an extremely risky form of investment and is only suitable for individuals and institutions capable of handling the potential losses it entails. An account with a broker allows you to trade foreign currencies on a highly leveraged basis (up to about 400 times your account equity).

The funds in an account that is trading at maximum leverage may be completely lost if the position(s) held in the account experiences even a one percent swing in value, given the possibility of losing one's entire investment. Speculation in the foreign exchange market should only be conducted with risk capital funds that, if lost, will not significantly affect the investors financial well-being.

10 Reasons To start Forex Market Trading

Forex Trading School - Understanding Forex Trading

Choosing A Forex Trading System

Investments - How To Invest Wisely And Grow Your Money

Browse All Our Informative Topics

InternetBusinessIdeas-Viralmarketing Homepage

Tweet

Follow @Charlesfrize