Stock Market

Growth and Value: What's the Difference?

Stock market: While the majority of investors understand the importance of diversifying across growth and value investments, few are able to achieve a passing grade on a test of their knowledge of the differences between the two, according to a new survey. Test your knowledge with the Growth and Value IQ quiz below:

1. Which best describes a growth stock?

- a) Stock that offers guaranteed rate of growth tied to consumer price index.

- b) Stock in a company specializing in agriculture, lumber, landscaping, and other organic products.

- c) A stock in a company demonstrating better than average profit and earnings gains.

- d) All of the above.

2. Which best describes a value stock?

- a) Stock in fast-growing company specializing in high-value, low-cost products, like a discount retailer.

- b) Stock in a company specializing in valuable goods, like precious metals and jewelry.

- c) Stock that has a low price-to-book ratio.

- d) All of the above.

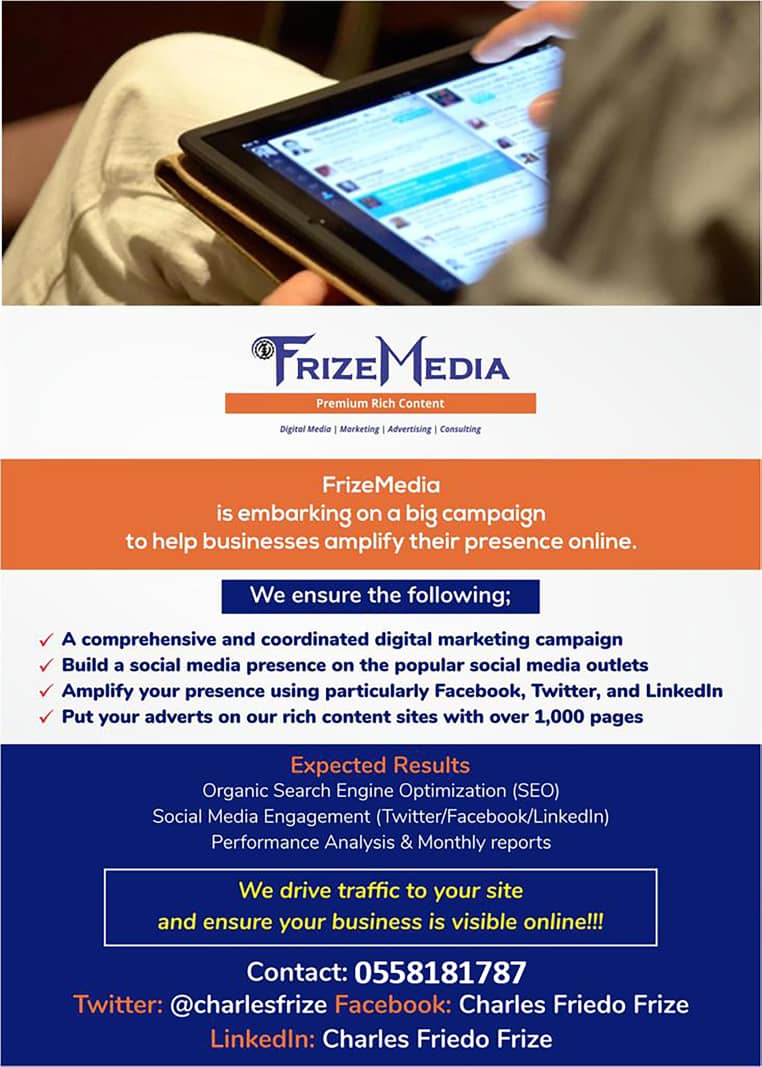

FrizeMedia Ghana SEO SEM Digital Marketing Proposal

The Best And Top Digital Marketing And SEO Services In Ghana

3. Which statement is true?

- a) Value stocks outperformed growth stocks between 1927 and 2001.

- b) Smaller company value stocks outperformed larger company value stocks between 1927 and 2001.

- c) Maintaining a portfolio with a combination of growth and value stocks generally is considered a prudent investment approach.

- d) All of the above.

4. During periods of strong economic expansion, which fund generally performs better?

- a) Growth.

- b) Value.

- c) Neither.

- d) Both.

5. Generally speaking, value funds outpaced growth funds in 2000 and 2001.

- a) True.

- b) False.

6. Generally speaking, growth funds outpaced value funds during the 1990s.

- a) True.

- b) False.

7. Which type of fund is more likely to invest in stocks paying a significant dividend?

- a) Growth.

- b) Value.

- c) Neither.

- d) Both.

8. Higher price-to-earnings ratios normally would be associated with stocks in which type of mutual fund?

- a) Growth.

- b) Value.

- c) Neither.

- d) Both.

9. What kind of stock is described in this example:

"Established baked-goods company with strong balance sheet and good cash flow experiencing temporary drop in reaction to changes in senior management."

- a) Growth.

- b) Value.

- c) Neither.

10. What kind of stock is described in this example:

"Software company, enjoying steady sales increases, is in the process of rolling out an eagerly anticipated update to a popular software application."

- a) Growth.

- b) Value.

- c) Neither.

Key: 1(c); 2(c); 3(d); 4(a); 5(a); 6(a); 7(b); 8(a); 9(b); 10(a).

The stock market is about reading the market,cycles,history,emotions. To truly succeed,you need to invest in all of the lists mentioned. When you are able to put your emotions to one side,learn the history of the markets,watch for the cycles,you are best placed to perform much better than the average person going in blind folded.

Differences Between Down And Out Stocks

The History Of Income Tax In The U.S.

The Four Major Forms Of Fundraising

What Does Your Credit Rating Say About You?

Greed And Fear Are Major Factors In The Markets

How To Start Trading The Forex Market

InternetBusinessIdeas-Viralmarketing Home Page

Tweet

Follow @Charlesfrize

New! Comments

Have your say about what you just read! Leave a comment in the box below.