Stock Market

The Difference Between Down And Out

Stock market: A lot of investors prefer to invest in companies that are down but not out. This is important because a lot of times, investors misunderstood the two. Often times, these two types of companies are trading near or at their 52 week low. But the similarity ends there.

Company that is Down. This is the company that experiences problem and it seems like it can weather the problem. It just needs time to right the ship and get back on track. How can we be certain that the company can weather the storm? The ultimate guideline is to look at the company's balance sheet and income statement.

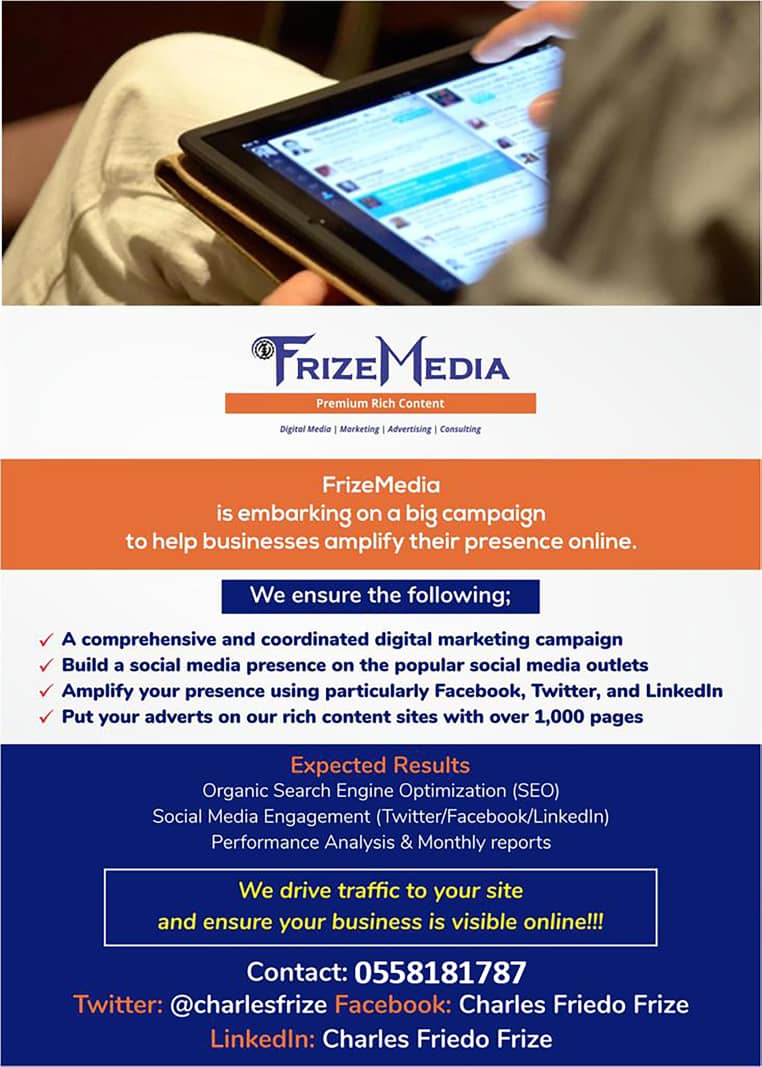

FrizeMedia Ghana SEO SEM Digital Marketing Proposal

The Best And Top Digital Marketing And SEO Services In Ghana

Does the company have a positive net cash? Is the company expected to post a profit? If the answer is yes to both questions, then the company in question is most likely is just down, but not out.

Company that is Out. This is the company that experiences problem but its future existence might be in doubt. It might right the ship but by then it might be too late. As a result, shareholders will be wiped out and lose 100% of their investment. How can we be certain for the company that is out? Again, we have to check the ultimate guideline, which is the balance sheet and income statement of the company.

Does the company have a negative net cash? Is the company expected to post a loss for the foreseeable future? If the answer is yes to both questions, then the company in question has the high probability of being out of business. Using analogy without illustrations are confusing, in my opinion. Therefore, I will choose one company for each situation. Please do not treat this as a buy or sell recommendation. This is merely an illustration. Company ABC might be categorized as the company that is down.

Stock price slumped to 8 year low this week due to weak sales of its drug franchises and tepid guidance. Management has refused to update guidance for the next three quarters and beyond due to uncertainty. So, let's look at the balance sheet, shall we? The latest information shows that the company has $ 15 Billion of cash and equivalent of $ 5.517 Billion in long term debt. In other words,it has $9.5 Billion of positive net cash. How about earnings? Is Company ABC expected to post a loss? Nope, it is expected to post earnings of $ 1.95 per share for year or $ 14 Billion of net profit. Profit is plenty while balance sheet is solid. Company ABC clearly is a company that simply has a small bump in the road.

How about Company XYZ? This is an excellent example of a company that is out. Looking at the balance sheet, Company XYZ has a negative net cash of $ 9.5 Billion. What this means is that it has $ 9.5 Billion more long term debt than it has cash. Is XYZ profitable? Not a chance.

It is expected to post a loss of $ 4.36 per share for the year or $ 714 Million. It doesn't look pretty. High amount of debt and big loss is the recipe for a company that is down. If XYZ doesn't turn its ship anytime soon, it might be forced to file bankruptcy. To consistently make money, investors need to be able to differentiate the company that is down and company that is out. Weed out the company that is out and your investment return will be so much better.

Greed And Fear Are The Major Factors In The Markets

Catch The Entrepreneurship Spirits

Growth And Value.What's The Difference?

Do You Have The Characteristics Of An Entrepreneur?

What Is The Difference Between Growth And Value?

Develop The Mindset Of A Wealth Creator

What Are The Four Major Forms Of Fundraising?

In Many Cases Leasing Is Better Than Buying

Browse All Our Informative Topics

InternetBusinessIdeas-Viralmarketing Home Page

Tweet

Follow @Charlesfrize

New! Comments

Have your say about what you just read! Leave a comment in the box below.