Taxes

Understanding Marketing Tax Deductions

Taxes : Marketing is a necessary expense in running practically any business and the IRS acknowledges as much. You may run advertisements on or in the Internet, radio, television, magazines, newspapers and other media to sell your products or services. You should be deducting all of the associated costs on your tax returns.

Ordinary Marketing Expenses Marketing costs must be "ordinary and necessary" business expenses in order to be deductible. Put in layman's terms, your marketing must be reasonably related to the promotion of your business and the expense amount must be a reasonable amount.

Deductible Marketing Expenses Common deductible marketing expenses include the costs associated with the following items:

- A. Online Advertisements,

- B. Business Cards,

- C. Advertisements in print media such as newspapers,

- D. Telemarketing,

- E. Business Cards,

- F. Web site costs including creation and maintenance,

- G. Costs for Advertisements on the Internet,

- H. Billboards, and

- I. Graphic design costs.

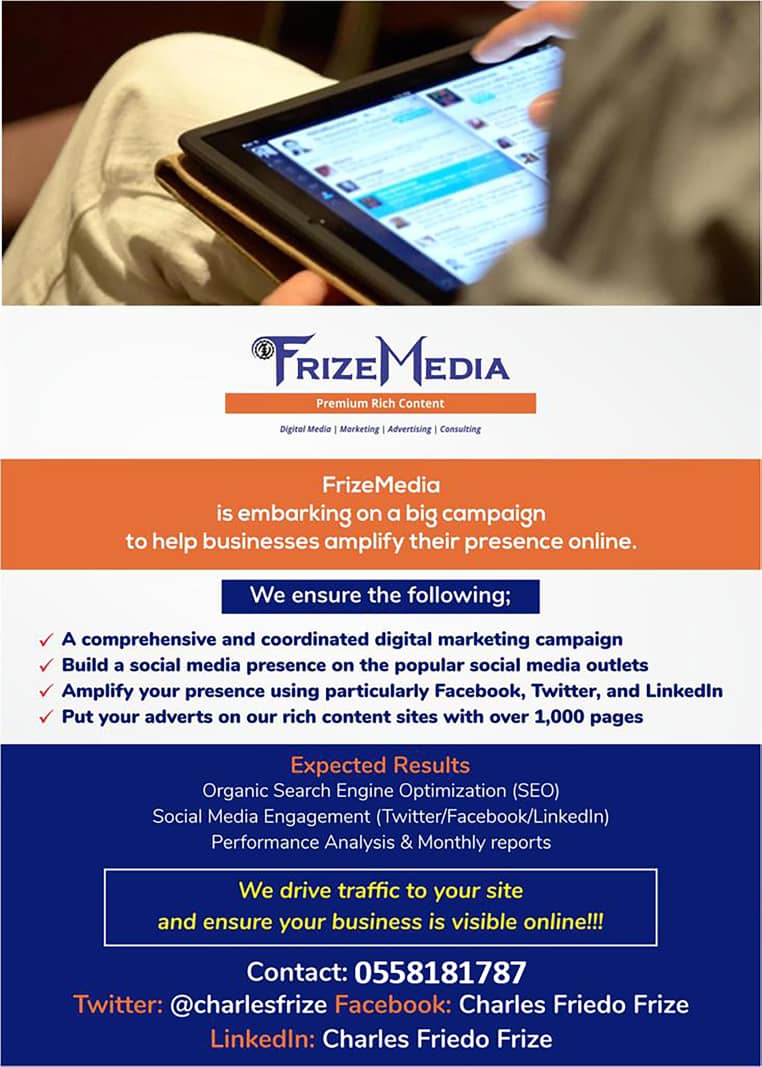

FrizeMedia Ghana SEO SEM Digital Marketing Proposal

The Best And Top Digital Marketing And SEO Services In Ghana

Goodwill Marketing For Your Business Marketing that is intended to portray your business positively can be deducted. Such marketing creates a long-term potential for business and, thus, falls within the ordinary and normal requirements of the tax code. Examples of such marketing include:

A. Sponsoring local youth sports teams,

B. Distributing samples of your business product, and

C. Costs associated with prizes offered by your business in a contest.

As long as your marketing expenses can be reasonably related to the promotion of your business, you should be deducting said expenses from your gross revenues. If you failed to claim any such expenses on your tax returns, your probably overpaid your taxes. It is prudent to always seek the advice of a tax specialist in all your tax affairs.

Your Online Business And Taxes

InternetBusinessIdeas-Viralmarketing Homepage

Tweet

Follow @Charlesfrize